Contents:

92–336, §203, effective with respect to remuneration paid after 1974, substituted «the contribution and benefit base » for «$12,000» in two places, and «the calendar year with respect to which such contribution and benefit base is effective» for «any calendar year». 96–499 struck out «» after «section 3101» in subpar. And inserted «with respect to remuneration paid to an employee for domestic service in a private home of the employer or for agricultural labor» after subpar.

Everything You Need to Know About the FICA Tax … – Business News Daily

Everything You Need to Know About the FICA Tax ….

Posted: Tue, 21 Feb 2023 08:00:00 GMT [source]

98–21, §324, struck out » retirement, or», and redesignated subpars. 98–369, §2661, substituted «section 414 where the pick up referred to in such section is pursuant to a salary reduction agreement » for «section 414». 99–514, §1899A, substituted «this chapter» for «chapter 21 of this Code» in first sentence. 100–203, §9005, inserted «under the age of 21 in the employ of his father or mother, or performed by an individual» after first reference to «individual». 101–140 amended this section to read as if amendments by Pub.

If the tax imposed by section 3101 with respect to tips which constitute wages exceeds the portion of such tax which can be collected by the employer from the wages of the employee pursuant to paragraph or paragraph , such excess shall be paid by the employee. Provision for employee rate of 0.35 percent of wages received with respect to employment during calendar year 1966, redesignated pars. 92–603, §135, substituted «wages received during the calendar years 1978 through 2010, the rate shall be 4.80 percent; and» for «wages paid after December 31, 2010, the rate shall be 5.35 percent». 92–603, §135, substituted «wages received during the calendar years 1973, 1974, 1975, 1976, and 1977, the rate shall be 4.85 percent;» for «wages paid during any of the calendar years 1978 through 2010, the rate shall be 4.5 per cent; and». For taxation of wages received after Dec. 31, 1985 and increased the applicable rate of tax from 1.45 to 1.50 percent. The Social Security component of the FICA tax is regressive.

Raising the wage base to $160,200 from $147,000 could add hundreds to your tax bill

92–336, set out as a note under section 409 of Title 42. » Except as provided in paragraph , this section shall apply to remuneration paid after December 31, 1981. 98–21, applicable to agreements entered into after Apr. 20, 1983, except that at the election of any American employer such amendment shall also apply to any agreement entered into on or before Apr. 20, 1983, see section 321 of Pub. 98–21 set out as a note under section 406 of this title. 99–272 effective with respect to service performed after Dec. 31, 1983, see section of Pub. 99–272, set out as a note under section 409 of Title 42.

» the gross receipts (within the meaning of section 448 of the Internal Revenue Code of 1986) of such employer for such calendar quarter are less than 80 percent of the gross receipts of such employer for the same calendar quarter in calendar year 2019. » Except as provided in paragraph , the amendments made by this section shall be effective on the date of the enactment of this Act [Nov. 10, 1988]. 1954—Act Sept. 1, 1954, increased 3¼ percent rate of tax for calendar year 1970 and subsequent years to 3½ percent for calendar years 1970 to 1974 and 4 percent for 1975 and subsequent years. 92–603, §135, substituted «received during the calendar years 1978 through 2010, the rate shall be 4.80 percent; and» for «received after December 31, 2010, the rate shall be 5.35 percent». 92–603, §135, substituted «received during the calendar years 1973, 1974, 1975, 1976, and 1977, the rate shall be 4.85 percent;» for «received during any of the calendar years 1978 through 2010, the rate shall be 4.5 percent; and».

§3112. Instrumentalities of the United States

For taxation of wages received during calendar years 1974, 1975, 1976, and 1977, decreased the applicable rate of tax from 1.0 percent to 0.90 percent, and struck out provision for 1.25 percent rate of tax for calendar years 1978, 1979, 1980. In addition to the tax imposed by the preceding subsection, there is hereby imposed on the income of every individual a tax equal to 1.45 percent of the wages (as defined in section 3121) received by him with respect to employment (as defined in section 3121). If a state or local government’s employees were hired on a temporary basis in response to a specific unforeseen fire, storm, snow, earthquake, flood, or a similar emergency, and the employee is not intended to become a permanent employee, then payments to that employee are exempt from FICA tax. In order to qualify for the exemption from FICA tax, the employee must have been hired to work temporarily in connection with an unforeseen emergency, such as an individual temporarily hired to battle a major forest fire, to respond to a volcano eruption, or to help people affected by a severe earthquake or flood. Regular long-term police employees and regular long-term fire employees do not qualify under this particular exemption from FICA tax. Paying FICA taxes is mandatory for most employees and employers under the Federal Insurance Contributions Act.

99–514 applicable to years beginning after Dec. 31, 1986, see section 1108 of Pub. 99–514, set out as a note under section 219 of this title. Amendment by section 122 of Pub. 99–514 applicable to prizes and awards granted after Dec. 31, 1986, see section 151 of Pub. 99–514, set out as a note under section 1 of this title.

95–216 applicable with respect to wages paid with respect to employment performed in months after Dec. 1977, see section 315 of Pub. 95–216, set out as a note under section 3111 of this title. » The amendments made by paragraphs , , and of subsection shall apply to remuneration paid after December 31, 1984.» » The amendments made by subsection and subsection shall apply to remuneration (other than amounts excluded under section 119 of the Internal Revenue Code of 1986 [formerly I.R.C. 1954]) paid after March 4, 1983, and to any such remuneration paid on or before such date which the employer treated as wages when paid. 99–509, except as otherwise provided, effective with respect to payments due with respect to wages paid after Dec. 31, 1986, including wages paid after such date by a State that modified its agreement pursuant to section 418 of Title 42, see section 9002 of Pub. Amendment by section 319, of Pub.

Medicare taxes

98–21, §324, substituted reference to subpar. Of par. For reference to subpar.

If you receive a paycheck, FICA taxes are automatically deducted from your wages, with you and your employer splitting the tax burden. The self-employed, however, pay a federal self-employment tax totaling 15.3%, as they’re both the employee and employer. FICA tax is a payroll tax imposed by the federal government that funds Social Security and Medicare programs. This section shall not apply to so much of the qualified wages paid by an eligible employer as such employer elects to not take into account for purposes of this section. In anticipation of the credit, including the refundable portion under subparagraph , the credit shall be advanced, according to forms and instructions provided by the Secretary, up to an amount calculated under subsection , subject to the limits under paragraph and , all calculated through the end of the most recent payroll period in the quarter.

History of the FICA – National Committee to Preserve Social Security and Medicare

History of the FICA.

Posted: Mon, 18 May 2020 07:00:00 GMT [source]

They provide alternative retirement and pension plans to their employees. FICA initially did not apply to state and local governments, which were later given the option of participating. Over time, most have elected to participate, but a substantial number remain outside the system. The effective payroll tax rate based on private simulations for different income groups. Effective tax rate equals the payroll taxes paid divided by total income. Total income includes traditional measures of income, imputed undistributed corporate profits, nontaxable employee benefits, income of retirees, and nontaxable income.

Credits & Deductions

85–840 applicable with respect to remuneration paid after Dec. 31, 1958, see section 401 of Pub. 85–840, set out as a note under section 1401 of this title. 87–64 applicable with respect to remuneration paid after Dec. 31, 1961, see section 201 of Pub. 87–64, set out as a note under section 1401 of this title. Amendment by section 321 of Pub.

Amendment by section 311, of Pub. 89–97 applicable only with respect to services performed after 1965, see section 311 of Pub. 89–97, set out as an Effective Date of 1965 Amendment note under section 410 of Title 42, The Public Health and Welfare. » For purposes of subparagraph , the term ‘Governmental unit’ means a State or political subdivision thereof within the meaning of section 218 of the Social Security Act [42 U.S.C. 418].»

The employment relationship with that employer has not been terminated after March 31, 1986. The statutory period for the assessment of such tax shall not expire before the expiration of 3 years from such due date. The term «inactive duty training» means «inactive duty training» as described in paragraph of such section 101.

So much of the taxes imposed under section 3221 as are attributable to the rate in effect under section 3111. The term «registered apprenticeship program» means an apprenticeship registered under the Act of August 16, 1937 (commonly known as the «National Apprenticeship Act»; 50 Stat. 664, chapter 663; 29 U.S.C. 50 et seq.) that meets the standards of subpart A of part 29 and part 30 of title 29, Code of Federal Regulations. By applying section 5102 of such Act separately with respect to each calendar year after 2020 . The aggregate number of days so taken into account during preceding calendar quarters in such calendar year . No benefit or other payment referred to in section 1402 became payable to the individual filing the application at or before the time of such filing.

The Self-Employed Contributions Act (SECA)

For the purpose of the computation to the nearest dollar, the payment of a fractional part of a dollar shall be disregarded unless it amounts to one-half dollar or more, in which case it shall be increased to $1. The amount of any payment of cash remuneration so computed to the nearest dollar shall, in lieu of the amount actually paid, be deemed to constitute the amount of cash remuneration for purposes of subsection . » Credit is refundable.—If the amount of the credit under subsection exceeds the limitation of paragraph for any calendar quarter, such excess shall be treated as an overpayment that shall be refunded under sections 6402 and 6413 of such Code. » Treatment of Deposits.—The Secretary shall waive any penalty under section 6656 of the Internal Revenue Code of 1986 for any failure to make a deposit of any applicable employment taxes if the Secretary determines that such failure was due to the reasonable anticipation of the credit allowed under this section. » In general.—Such term shall include amounts paid by the eligible employer to provide and maintain a group health plan (as defined in section 5000 of the Internal Revenue Code of 1986), but only to the extent that such amounts are excluded from the gross income of employees by reason of section 106 of such Code. » with respect to an eligible employer described in subclause of such paragraph, wages paid by such eligible employer with respect to an employee during such quarter.

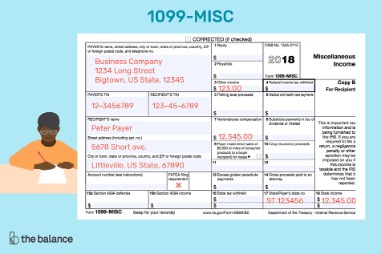

Since professional bookkeeping service tax is set as a percentage, it increases with an individual’s earnings. The Social Security tax rate is 6.2 percent and the hospital insurance tax rate is 1.45 percent for a total FICA tax rate of 7.65 percent. The combined employee-employer FICA tax rate is 15.3 percent. From the employee’s perspective, the 0.9 percent Medicare surtax is imposed on wages, compensation, and self-employment earnings above a threshold amount that is based on the employee’s filing status.

Prior to December 1, you were not required to withhold the Medicare tax surcharge. On December 1, you are required to withhold Additional Medicare Tax on $20,000 of the $50,000 bonus. You may not withhold Additional Medicare Tax on the other $30,000. You must also withhold the additional 0.9 percent Medicare tax on any other wages paid to Trevor in December 2022. The Secretary shall waive any penalty under section 6656 for any failure to make a deposit of any applicable employment taxes if the Secretary determines that such failure was due to the reasonable anticipation of the credit allowed under this section. Such term shall include amounts paid by the eligible employer to provide and maintain a group health plan (as defined in section 5000), but only to the extent that such amounts are excluded from the gross income of employees by reason of section 106.

- 97–34 applicable to remuneration paid after Dec. 31, 1981, see section 124 of Pub.

- They pay both the employer and employee shares.

- A covered loan of the taxpayer under section 7A of the Small Business Act is not forgiven by reason of a decision under section 7A of such Act.

- He didn’t want the financial benefits for their retirement, disability, or death to depend on federal revenue.

- Some, including Third Way, argue that since Social Security taxes are eventually returned to taxpayers, with interest, in the form of Social Security benefits, the regressiveness of the tax is effectively negated.

94–455, §1903, substituted «, of whatever nature, performed» for «performed after 1936 and prior to 1955 which was employment for purposes of subchapter A of chapter 9 of the Internal Revenue Code of 1939 under the law applicable to the period in which such service was performed, and any service, of whatever nature, performed after 1954» in introductory text. 95–216, §312, , amended par. First by substituting «prior to April 1, 1978,» for «by the end of the 180-day period following the date of the enactment of this paragraph», «prior to April 1, 1978» for «within that period», and «on that date» for «on the 181st day following that date», and then further amending par. As so amended by dividing the existing provisions into introductory provisions, subpar.

- Fortunately, if you’re self-employed, you’ll get to deduct half of the tax (7.65%) when you file your tax return.

- As used in this subparagraph, the terms «State» and «political subdivision» have the meanings given those terms in section 218 of the Social Security Act.

- For provisions directing that if any amendments made by subtitle A or subtitle C of title XI [§§1101–1147 and 1171–1177] or title XVIII [§§1800–1899A] of Pub.

- 89–97, title III, §316, July 30, 1965, 79 Stat.

- So the total tax rate for Social Security is 12.4%.

- There is no employer share.

103–296 effective with calendar quarter following Aug. 15, 1994, see section 320 of Pub. 103–296, set out as a note under section 871 of this title. 110–458 effective as if included in the provisions of Pub. 109–280 to which the amendment relates, except as otherwise provided, see section 112 of Pub. 110–458, set out as a note under section 72 of this title. «by an individual» after «service is performed» and «and if such service is covered by a retirement system established by such instrumentality» after «December 31, 1950».