Content

The basic premise behind using the liability method for reporting unearned sales is that the amount is yet to be earned. Till that time, the business should report the unearned revenue as a liability. A few typical examples of unearned revenue include airline tickets, prepaid insurance, advance rent payments, or annual subscriptions for media or software. Understanding the basics of accounting is vital to any business’s success. Under the accrual basis of accounting, recording deferred revenues and expenses can help match income and expenses to when they are earned or incurred. This helps business owners more accurately evaluate the income statement and understand the profitability of an accounting period.

It can include things like interest earned on money in the company’s bank account. For example, getting paid upfront means you don’t need to chase up customers for overdue invoices or wonder when you’re going to receive the money. The «deferred payment» situation occurs when the seller delivers goods or services before the customer pays. Later, when part 2 of the sale occurs, the buyer and the seller each make another pair of journal entries, such as those shown in Exhibit 3. The seller cannot claim «revenue earnings,» and the buyer cannot claim «expense payment,» until both parts of the sale transaction complete.

Accounting for Unearned Revenue

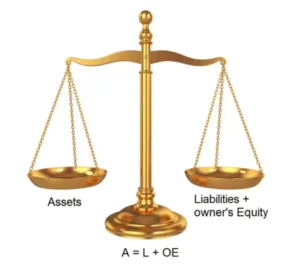

On January 1st, to recognize the increase in your cash position, you debit your cash account $300 while crediting your unearned revenue account to show that you owe your client the services. Hence, $ 1000 of unearned income will be recognized as service revenue. The Shareholders’ Equity Statement on the balance sheet details the change in the value of shareholder’s equity from the beginning to the end of an accounting period.read more. According to the accounting reporting principles, unearned revenue must be recorded as a liability. If the value was entered as an asset rather than a liability, the business’s profit would be overstated for that accounting period.

On December 28 the company will debit Cash for $5,000 and will credit a liability account, such as Customer Deposits (or Unearned Revenues or Deferred Revenues) for $5,000. No revenue is reported in December for this special order since the company did not perform any work in December. When the special order begins and is completed in January, the company will debit the liability what is unearned revenue account for $5,000 and will credit a revenue account. If the company was not to deal with unearned revenue in this manner, and instead recognize it all at once, there would initially be an understatement in revenues and profit. On the other hand, there will be an understatement for the additional periods during which the revenues and profits were supposed to have been recognized.

Deferred Revenue Recognition Compliance

What happens when your business receives payments from customers before providing a service or delivering a product? This journal entry reflects the fact that the business has received payment from its customer, but has not yet fulfilled its obligation to provide the landscaping services. As a result, the revenue is considered unearned and is recorded as a liability on the balance sheet. The deferred payments are recorded as current liabilities in the balance sheet of a company as the products or services are expected to be delivered within the current year. Once the goods or services are delivered, the entry is converted to a revenue entry through a journal.

As long as the transactions are posted back-to-back, which should always be the case, there is no residual balance left in the Unearned Income account. As an example, we note that Salesforce.com reports unearned revenue as a liability (current liabilities). Most large corporations use the accrual accounting method and are required to follow GAAP (generally accepted accounting principles). If the product or service https://www.bookstime.com/articles/how-to-fill-out-w-4 is delivered incrementally instead of all at once, then revenue should be recognized equal to the amount of goods being exchanged. Generally, it’s more common for companies who provide services to get paid in advance compared to those who provide a physical product. Unearned income is income that a company receives from investments or other sources that aren’t related to its main business activities.

Enjoying reading this article?

However, a business owner must ensure the timely delivery of products to its consumers to keep transactions steady and drive customer retention. This is why it is crucial to recognize unearned revenue as a liability, not as revenue. A business owner can utilize unearned revenue for accounting purposes to accurately reflect the financial health of the business. This type of revenue, for one, provides an opportunity to help small businesses with cash flow and working capital to keep operations running and produce goods or provide services. However, understanding how unearned revenue impacts the books and customer relationships is key to making the most out of this financial component.

- This approach can be more precise than straight line recognition, but it relies upon the accuracy of the baseline number of units that are expected to be consumed (which may be incorrect).

- This is why it is crucial to recognize unearned revenue as a liability, not as revenue.

- Get the reversal approved by a higher-up and keep a log of the change.

- Unearned revenue (aka deferred revenue) is a liability that gets created on the balance sheet when your company receives payment in advance.

So $100 will come out of the revenue account and you will credit your expense account $100. It is important to perform these adjusting entries to recognize deferred revenue according to the contract set in place. Unearned revenue and deferred revenue are the same things, as are deferred income and unpaid income. These are are all various ways of referring to unearned revenue in accounting. Since unearned revenue is cash received, it shows as a positive number in the operating activities part of the cash flow statement.